|

Guardian: FTSE 100 plunges 6% to one-year low amid market turmoil |

项目经理 二十四级 |

Japan’s Nikkei 225 tumbles nearly 9% on Monday as Hong Kong’s Hang Seng down 8% and South Korea trading temporarily halted amid Trump tariff concerns

Full headline: FTSE 100 plunges 6% to one-year low amid market turmoil, as Goldman Sachs raises chances of US recession to 45% – business live

|

项目经理 二十四级 |

8h ago02.37 BST Hong Kong and Chinese stocks dive Hong Kong stocks have plummeted more than 9% at open, while Singapore stocks dropped over 7%, according to reports. Hong Kong and Chinese stocks dived on Monday as markets around the world crumbled in the face of the widening global trade war and fears it will unleash a deep recession, Reuters says. Hong Kong’s Hang Seng index was down 8% in early trade. Shares in online giants Alibaba and Tencent were down more than 8%. China’s CSI300 blue-chip index fell 4.5%. China, which is now facing US tariffs of more than 50%, responded in kind on Friday by slapping extra levies on US imports.

|

项目经理 二十四级 |

8h ago02.30 BST Taiwan stocks plummeted almost 10% on Monday in their first trading since Donald Trump announced his new tariffs regime last week, with the head of the island’s stock exchange saying it would roll out more stabilisation policies if needed. After opening on Monday following a two-day market holiday on Thursday and Friday, Taiwan’s benchmark index dropped to its lowest level in more than a year, Reuters reports. Taiwan’s top financial regulator on Sunday announced it would impose temporary curbs lasting all this week on short-selling of shares to help deal with potential market turmoil from the tariffs. Shares in chipmaker TSMC and electronics maker Foxconn both fell near 10%, triggering the 10% circuit breaker in the Taiwan market. Speaking to reporters shortly after the market opened, Taiwan stock exchange chairman Sherman Lin said it would coordinate with the financial regulator to take further stabilisation steps if needed. The stock exchange would maintain flexibility in stabilisation measures this week to handle volatility stemming from new U.S. import tariffs, Lin added. He said it would be hard for Taiwan to escape the market impact of the tariffs, but called on investors to have confidence in Taiwanese companies and the government.

|

项目经理 二十四级 |

8h ago02.12 BST US Treasury yields fell on Monday and the two-year yield sank to a multi-year low as worries of a possible recession in the world’s largest economy grew and investors wagered that could see US rates cut as early as May. The two-year US Treasury yield, which typically reflects near-term rate expectations, tumbled more than 20 basis points to its lowest level since September 2022 at 3.4350%, as investors ramped up bets of more aggressive Federal Reserve easing this year, Reuters reports.

|

项目经理 二十四级 |

View image in fullscreen The US Federal Reserve building in Washington DC. Photograph: Daniel Slim/AFP/Getty Images

|

项目经理 二十四级 |

The benchmark 10-year yield last stood at 3.9158%, languishing near Friday’s six-month low of 3.8600%. Futures now point to nearly 120 basis points’ worth of Fed cuts by December and markets swung to imply a roughly 60% chance the US central bank could ease rates in May, as policymakers seek to shore up growth in the world’s largest economy on the back of President Donald Trump’s latest tariff salvo. JPMorgan ratcheted up its odds for a U.S. and global recession to 60%, as mentioned, and brokerages elsewhere similarly raised their probability of a US recession as tariff distress threatens to sap business confidence and slow global growth.

|

项目经理 二十四级 |

9h ago01.57 BST Nikkei plunge nears 9% as Japanese bank stocks plummet Japan’s Nikkei share average tumbled nearly 9% early on Monday, while an index of Japanese bank stocks plunged as much as 17%, as concerns over a tariff-induced global recession continue to rip through markets. The Nikkei dropped as much as 8.8% to hit 30,792.74 for the first time since October 2023. The index was trading down 7.3% at 31,318.79, as of 0034 GMT, Reuters reports. All 225 component stocks of the index were trading in the red. The broader Topix sank 8% to 2,284.69. A topix index of banking shares slumped as much as 17.3%, and was last down 13.2%. The bank index has borne the brunt of the sell-off in Japanese equities, plunging as much as 30% over the past three sessions.

|

项目经理 二十四级 |

9h ago01.45 BST Nikkei plummets nearly 8% The Nikkei 225 has now dived nearly 8% after the Wall Street meltdown over Donald Trump’s tariffs. Japan’s benchmark stock index sank 7.8% to lows last seen in late 2023. South Korea lost 4.6%. As reported earlier, Trump said of the falling markets that “medicine” could be necessary at times and he was not intentionally engineering a market selloff. “I don’t want anything to go down, but sometimes you have to take medicine to fix something,” the US president told reporters aboard Air Force One.

|

项目经理 二十四级 |

View image in fullscreen Donald Trump talks to media aboard Air Force One on Sunday. Photograph: Kent Nishimura/Reuters

|

项目经理 二十四级 |

The market carnage came as White House officials showed no sign of backing away from their sweeping tariff plans, Reuters reports, and China declared the markets had spoken on their retaliation through levies on US goods. Trump said he would not do a deal with China until the US trade deficit was sorted out.

|

项目经理 二十四级 |

9h ago01.38 BST Almost $5tn was wiped off the value of global stock markets last week after Donald Trump launched his tariff offensive last Wednesday. The US market was particularly hard hit. The benchmark S&P 500 lodged its biggest weekly drop since March 2020 and the Nasdaq Composite on Friday ended down more than 20% from its December record high, confirming the tech-heavy index is in a bear market. The Dow Jones Industrial Average finished the week down well over 10% from its December record high, marking a correction for the blue-chip index.

|

项目经理 二十四级 |

9h ago01.32 BST Oil prices fell more than 3% on Monday – extending losses from the previous week – on growing concerns that a global trade war could slow the global economy and weaken oil demand. Brent futures declined $2.1, or 3.2%, to $63.48 a barrel at 1027 GMT, while US West Texas Intermediate crude futures lost $2.14, or 3.5%, to $59.85, Reuters reports. Both benchmarks plunged 7% on Friday to settle at their lowest in over three years as China ramped up tariffs on US goods in retaliation at Donald Trump’s tariffs, escalating a trade war that has led investors to price in a higher probability of recession.

|

项目经理 二十四级 |

View image in fullscreen File photo of a pumpjack from US-based energy company Signal Hill Petroleum in California. Photograph: Frederic J Brown/AFP/Getty Images

|

项目经理 二十四级 |

Responding to Trump’s tariffs, China on Friday said it would impose additional levies of 34% on American goods, confirming investor fears that a full-blown global trade war is under way. Investment bank JPMorgan said it now saw a 60% chance of a global economic recession by year-end, up from 40% previously.

|

项目经理 二十四级 |

9h ago01.25 BST Nikkei drops over 7% Japan’s Nikkei index has plunged more than 7%, Agence France-Presse is reporting, after having it down 5% and, a little earlier, 3.6% following its opening today. The fall extends last week’s 9% drop – its steepest one-week percentage decline since March 2020.

|

项目经理 二十四级 |

9h ago01.18 BST You have to 'take medicine' sometimes – Trump Donald Trump has said about falling markets that “medicine” can be necessary at times, adding that he was not intentionally engineering a market selloff. “I don’t want anything to go down, but sometimes you have to take medicine to fix something,” the US president told reporters aboard Air Force One on the economic fallout from his sweeping tariffs.

|

项目经理 二十四级 |

9h ago01.17 BST Welcome Hello and welcome to our business blog covering the global fallout to the tariffs imposed by Donald Trump last week. The US president’s decision to bring in levies of up to 50% on imports into the US rocked stock markets. As a new week dawns, traders, investors and consumers across the world are braced for further falls. Stay with us to follow all the developments.

|

项目经理 二十四级 |

From 3h ago 08.12 BST FTSE 100 plunges 6% to one-year low Britain’s stock market has plunged deep into the red at the start of trading. Stocks are sliding sharply again, adding to last week’s heavy losses, as investors grow more fearful that Donald Trump’s trade policies will lead to recession. In London, the FTSE 100 index of blue-chip stocks has plunged by 488 points, or 6%, taking the index down to 7566 points, its lowest level since February 2024. That’s an even more severe plunge than the near-5% wipeout on Friday after China retaliated against the US with its own new tariffs. Every share on the FTSE 100 is in the red, with UK manufacturing firm Rolls-Royce tumbling by 13%. Miners, banks, and investment firms are also in the top fallers. There is widespread disappointment this morning that there was no progress on US trade tariffs over the weekend, with Trump described his new tariffs as necessary ‘medicine’. Kathleen Brooks, research director at XTB, says investors are desperate to see ‘concrete action’, such as a pause or u-turn on Trump’s tariffs. This market is looking for concrete action, not talk of action. The best panacea for financial markets right now would be a pause or reversal from the US on its tariff programme.

|

项目经理 二十四级 |

19m ago10.24 BST We’ve reached the scale in the crisis when central banks are pondering whether to intervene in the markets. Over in Jakarta, Indonesia’s central bank said today it would “intervene aggressively” in domestic foreign exchange markets when they re-open on Tuesday for the first time since new U.S. tariffs were announced, Bloomberg reports. Bank Indonesia said in a statement that it had already intervened offshore in Asia, European and New York curency markets. It added: “Bank Indonesia’s series of measures are aimed at stabilising the rupiah exchange rate and maintaining the confidence of market participants and investors in Indonesia.” In Taipei, Taiwan’s central bank said it will intervene if necessary to ensure the stability of the Taiwan dollar exchange rate, ading that it has “sufficient ability” to deal with fluctuations.

|

项目经理 二十四级 |

31m ago10.12 BST We are now back on ‘US recession watch’ thanks to Trump’s tariffs, reports. Dario Perkins, City economist at TS Lombard. Perkins (inventor of the “moron risk premium” concept during the UK bond market crash under Liz Truss), told clients: With Liberation Day causing shockwaves across global markets (our expectations were low but holy…) we are now firmly back on US recession watch. Prices will rise, real incomes will drop, and it will be the labour market that determines what happens after that. As always, employment is the key to US recessions. "But it's just Wall Street, not Main Street?" 1. Tariffs are highly regressive, hitting people on low incomes hardest. 2. Corporate profits will decline and companies will respond by firing workers. That ain't good for "worker power" .. — Dario Perkins (@darioperkins) April 7, 2025"}}" data-island-status="hydrated" style="box-sizing: border-box;">

|

项目经理 二十四级 |

39m ago10.04 BST To no-one’s surprise, economic confidence across the eurozone has slumped this month. The Sentix Investor Confidence Index has tumbled to -19.5 points, its lowest level since October 2023, down from -2.9 in March. Sentix, the research group, explains that “Trump’s tariff hammer” has hammered optimism, with economic expectations for the eurozone now falling at a record pace. The report adds: US economic expectations fell to their lowest level since October 2008, while the tariff shock fuelled fears of a global recession. The Euro Zone Sentix Index plummeted to -19.5 in April, a significant drop from -2.9 in March, far worse than the Reuters poll estimate of -10.0. #EuroZone 📉 — MiloX Trading (@CryptoMilox) April 7, 2025\n\n"}}" data-island-status="hydrated" style="box-sizing: border-box;">

|

项目经理 二十四级 |

45m ago09.58 BST Gas prices are weakening today too, a sign that the markets are pricing in weaker economic growth and less demand for energy. The month-ahead price of UK gas has fallen by 3.6%, to 85.5p per therm, the lowest since last September. European gas prices fell more sharply; their benchmark futures fell as much as 8% on Monday after wiping out more more than 10% last week, Bloomberg reports, adding: Fears that US President Donald Trump’s trade restrictions will slow down the economy have caused commodity prices to plummet, with traders expecting it could spell less demand for energy shipments.

|

项目经理 二十四级 |

54m ago09.49 BST A Chinese foreign ministry spokesperson has warned that threats and pressure are not the right way to deal with China, after describing Donald Trump’s “reciprocal tariffs” as bullying. Spokesperson Lin Jian told a press conference today that the tariffs are “typical unilateralism and protectionism, and economic bullying”, Reuters reports, adding: “The abuse of tariffs by the United States is tantamount to depriving countries, especially those in the Global South, of their right to development.”

|

项目经理 二十四级 |

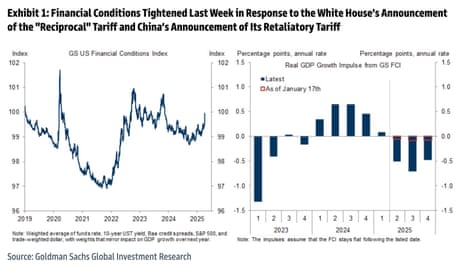

1h ago09.32 BST Goldman Sachs: 45% risk of US recession in next year Goldman Sachs has slashed its forecast for US economic growth this year, and warned there is a growing risk that America falls into recession in the next year. Goldman has lowered its 2025 growth forecast from 1.0% to 0.5%, due to fears that Donald Trump will raise tariffs by much more than it had expected. In a note titled “US Daily: Countdown to Recession”, Goldman also lifted its 12-month recession probability from 35% to 45%, following “a sharp tightening in financial conditions, foreign consumer boycotts, and a continued spike in policy uncertainty” following Trump’s tariff announcements. Goldman analysts explain that they had expected the White House to announce a more aggressive tariff at first and then scale it back; instead, the new tariffs scheduled for 9 April would lift the effective tariff rate by more than expected. They say: First, financial conditions tightened more aggressively than we had expected in response to the White House’s announcement of its “reciprocal” tariff and the Chinese government’s announcement of its retaliatory tariffs on US exports. This is partly because both announcements were more aggressive than expected. But it also suggests that the sensitivity of financial conditions to incremental tariffs is rebounding from the moderate levels of early 2025 toward the more outsized levels observed in the 2018-2019 trade war.

|

项目经理 二十四级 |

View image in fullscreen Photograph: Goldman Sachs

|

项目经理 二十四级 |

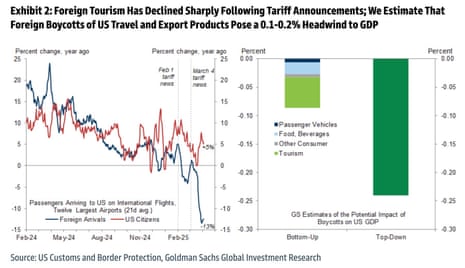

Second, our analysis of reduced foreign tourism to the US and foreign consumer boycotts suggests an additional 0.1-0.2pp hit to GDP growth in 2025. Our forecast had already assumed forceful retaliation by foreign governments, but we had not accounted for the effects of a consumer-led response. Third, measures of policy uncertainty have spiked to levels far above those reached during the last trade war. The effects of policy uncertainty are likely to be much larger than in the first trade war because far more US companies are likely to be affected by uncertainty about the much larger and broader US and foreign tariffs this time, and some could also be affected by uncertainty about other policy areas, such as fiscal and immigration policy.

|

项目经理 二十四级 |

View image in fullscreen Photograph: Goldman Sachs

|

项目经理 二十四级 |

2h ago09.15 BST Vix volatility index rising Wall Street’s ‘fear index’ is surging higher again today. The VIX index, which measures market volatility and uncertainty, has almost doubled today to around 60 points. It’s at its highest level since last August, when US recession fears hit markets. $VIX (market volatility index) is up 165% in the last five trading days 🫠💀 pic.twitter.com/FmNvybkMF8 — Philip Engberg (@philipengberg) April 7, 2025"}}" data-island-status="hydrated" style="box-sizing: border-box;"> [I initially thought it was the highest since March 2020, but it seems we’re not there yet….]

|

项目经理 二十四级 |

2h ago09.05 BST Should you be worried about the falls on the market?

Hilary Osborne Most people are investors through their pensions, even if not actively, so the sell-off could have an impact on their retirement funds. And even if they don’t have a pension, the sharp drop in share prices across the world could make a difference to their finances. On Friday my colleague Hilary Osborne took a look at what the turmoil means for people in the UK - you’ll find it here: What will stock market falls over Trump’s tariffs mean for UK pensions and savings?

|

项目经理 二十四级 |

2h ago09.04 BST

Helen Davidson In Taiwan, stocks plummeted so fast on Monday that it triggered the 10% circuit breaker early in the morning, my colleagues Jason Tzu Kuan Lu and Helen Davidson report from Taipei. The huge falls were driven by Taiwan tech giants TSMC and Foxconn. Playing the stock market is hugely popular in Taiwan, with about 5.6m of Taiwan’s 24m people actively trading. Individual investors accounted for more than 55% of all transactions in June 2024, according to the Taiwan stock exchange. It means there are a lot of mum and dad investors out there, reeling from the global economic fallout. At the Muzha market on the outskirts of Taipei, 65-year-old Mr T said he felt like the morning’s routing was an inevitable correction to market rises prior to Trump’s announcement. Monday was the first chance Taiwan’s market had to react to the 32% tariffs he put on the island, having been closed for a national holiday last Thursday and Friday. “Before the holidays, the market was rising, so now it’s just a normal correction. But we can’t predict where the drop will stop,” he told the Guardian. “What’s more concerning is the situation with TSMC’s poor performance in the U.S. When TSMC is struggling, everyone else is, too.” Zhou Tzu-wei, a 34-year-old producer in Taiwan said he’d seen some “plummeting” of the market in the past “but nothing as bad as today”. ““Almost everything is dropped to the limitation of stock price (10%).It feels like the market just closed seconds after its opening. Even companies with factories in the U.S. took a hit. Only basic necessities like gas were less affected (and actually went up).” Hou Dun-yi, a Taiwan-based actor, said he tried to clear his holdings before the open but “couldn’t sell a single share”. “I don’t know if something like this has ever happened in the history of the Taiwan stock market. I’m not sure what will happen next, either. Trump is just too unpredictable. Anyway, I plan to sell all my stocks and take a break from trading. I’m going to read more books, do some research, and focus on living with the cash I have for now.”

|